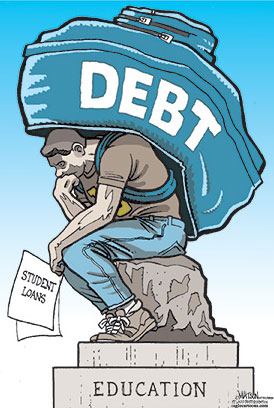

If you have student loans, you know what the challenge may be paid. Sometimes it might seem as though you never going to get ahead, and almost all their income goes into paying high interest rates on these loans. Perhaps this is why so many people have defaulted on their loans. When you add an expensive education, high interest rates to pay for it and a bad economy, it is not surprising that so many people struggling in this area.

It's pretty easy to find yourself in student loan debt collection trap, sometimes it's just as easy to get yourself out of a bad situation when the right steps.

* Know what your loans are and with whom. When you have a good idea of what you are paying and what you are paying, you'll be more likely to get in touch with them should you need. Often you can keep your student loans in good standing, if you're willing to call the lender and tell them your situation. Avoiding default on your student loans is always your best bet.

* Know your rights when it comes to billing. If you've gotten to this point, you should know that your lender will probably be willing to work with you, but you have to talk to them first. Tell them your situation and see what can be worked out. It is often better, because it can help prevent more aggressive action from being taken against you.

* If you find that you have a student loan default, and you are facing garnishment of your wages or other potentially drastic measures by the lender, you may want to consult a fair debt attorney. They can often help as possible for you to continue payments on your loan that you can better afford and help you avoid defaulting on them.

* You may also want to consider refinancing your loan before they become big problems. Refinancing is not going to go a long away, but it might help to keep your credit in good condition and lower interest rates to pay, you can easily afford.

* Sometimes, you need to dispute a student loan. Your fair debt attorney may be able to help advise you when it's time to take this step and how it can help your case.

student loans are great. They make many people means they need to get the education they want imati.Problem for many is that it can be very, very expensive to bring them back. By taking the right steps, you can avoid defaulting on your student loans and keep their credit and finances on a stable country.